Investment Opportunities with Benefits

If you earn at least $100,000 in passive income, or have clients that do, there could be a way to put those dollars to work. Doing so could benefit you even more. The advanced tax planning tool is especially helpful if you earn more than $628,300 as a married couple filing jointly.

It would help you remove dollars from the highest marginal tax bracket, which is currently 37% at the federal level. This is the goal of advanced tax planning. The perks include the potential for tax savings while investing in institutional real estate.

Let’s break down how this advanced tax planning works and see the benefits it could provide.

Looking at the Code

What if I told you that there was a provision that went into effect because of the Tax Cuts and Jobs Act? It can affect how your passive income is handled. This code provides advanced tax planning benefits for the 2022 and 2023 tax years. For our discussion, it’s worthwhile to look at what this regulation entails.

Per the code, an investment can be made into a gas station with a convenience store, commonly called a C-store (a core investment). If certain requirements are met, a bonus depreciation of 100% is available through the end of 2022. During the 2023 year, the percentage is reduced to 80% if the property is eligible.

To qualify, a property must be considered a “retail motor fuel outlet.” This means that it will need to meet at least one of the following tests:

- At least 50% of the gross revenues the stores generate come from the sale of petroleum.

- At least 50% of the floor space is dedicated to petroleum marketing sales.

- The building has a space of 1,400 square feet or less.

In addition, the C-store will need to be obtained and placed into service after September 27, 2017. For this reason, real estate portfolios that add C-store properties could benefit from significant depreciation opportunities available during 2022 and 2023.

An Example of Advanced Tax Planning

Let’s consider the following scenarios.

Scenario #1:

- An accredited investor (or higher investor status)

- Married filed jointly

- $1 million in annual income

- $300,000 of annual income is passive

- Living in Florida (no state or local tax)

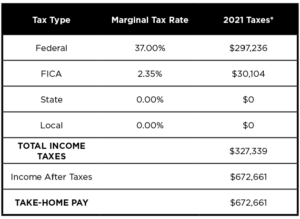

Only looking at it from a federal tax perspective, we see the following in taxes:

Now let’s consider the same investor, after making a $100,000 investment into a C-store.

Scenario #2:

- An accredited investor (or higher investor status)

- Married filed jointly

- $1 million in annual income

- $300,000 of annual income is passive

- Living in Florida (no state or local tax)

- $100,000 investment into a C-store

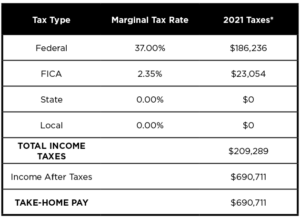

Note that in the first scenario, the investor owes $327,339 in taxes. In the second, after the investment, the taxes are $209,289. The second investor also benefits from the capital appreciation of the property (historically 3% to 5%) and the cash flow (usually 4% to 6%).

Getting Started With Advanced Tax Planning

Advanced tax planning is often used to consider scenarios such as these and their outcomes. This is typically done in Q3 or Q4 in a separate meeting with your tax professional and usually requires a separate fee. If your tax professional isn’t bringing you in at the end of the year and charging you a separate hourly or value-driven fee for tax planning, there is a high probability that they are not doing tax planning.

When was the last time your CPA brought you an idea that saved you over $100,000 in taxes? If you can’t remember, it might be time to add a tax planner to your team.

Contact information

Matthew M. Chancey, CFP®

Mobile (407) 832-0805

*all taxes and figures are based on estimations; they are not intended to project an actual scenario.