Understand Income Taxes for Accredited Investors

Is your annual income at least $200,000? Or do you have a net worth of $1 million (excluding the value of your home)? If so, you could qualify to be an accredited investor. If you meet these criteria or surpass them, you could benefit from advanced tax planning. That’s because there are opportunities available for individuals and households who attained certain levels of wealth or income.

To see how this works, it’s helpful to decipher the relationship between your income sources and tax bill. To do this, we’ll start by breaking down sources of income. After that, we’ll review tax brackets. We’ll consider how they affect your income as an accredited investor. Understanding these concepts could allow you to save on taxes and receive additional benefits if you follow the right strategy.

What Are 3 Sources of Income?

Let’s start by looking at the three major categories used to define income.

Active income

- The amount earned from employment—think of hourly wages, a salary, or commissions for sales.

Passive income

- The funds generated from investments, which include interest, dividends, and cash flow from rental properties.

Capital gains

- The profit received when an investment or property is sold.

The amount you bring in will be taxed at different rates, based on the income you receive from these categories. For 2022, the tax bracket for married couples filing jointly is:

The above applies to active and passive income. The IRS taxes capital gains in the following way:

Keep in mind that the tax brackets divide income into different levels. If your income as a married couple filing jointly is $1 million, the first $19,900 will be taxed at only 10%. The 37% rate applies to what you earn above $628,301.

The same principle applies to capital gains taxes. The first $80,800 you earn as a married couple filing jointly will not be taxed at all. Income between $80,801 and $501,600 will be taxed at 15%. Anything equal to or above $501,601 will fall into the 20% tax rate.

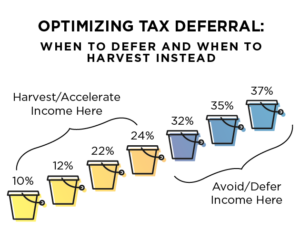

When I get asked about tax planning, I point out that there are strategies for mass affluent earners. However, the biggest opportunity lies when the percentage jumps from 24% to 32%. As you think about what you’ll be filing, you’ll want to focus on the dollars above the $329,851 threshold. Tax planning discussions typically center on ways to reduce the amount over that bucket.

The Importance of Tax Planning

For those with income that meets or exceeds the 32% bucket, there are advanced tax strategies that could be available to you. This typically occurs during the third and fourth quarter of the year.

You might move some of your passive income into a different investment. Doing so could save you tax dollars. If the investment involves the right strategy, you could receive an appreciating asset that also generates cash flow.

If your tax advisor is not inviting you into their office during the second half of the year to discuss your potential options, you could miss out on opportunities. This is the case for those who qualify as accredited investors or above.

Has your advisor discussed tax planning strategies with you? If not, it may be time to bring in an additional tax team member.

Contact information

Matthew M. Chancey, CFP®

Mobile (407) 832-0805